We are in the midst of mega-cap tech earnings, and it may seem like we are close to wrapping up earnings season, but we still have at least another month to go! While there are many earnings trading opportunities overnight, there are also opportunities for the Run into Earnings right now.

What is the Run into Earnings? It’s the time frame pre-earnings where stocks make big moves before their reports. Now, historically I have primarily focused on bullish runs. In a bull market, identifying relative strength stocks that will make directional moves in anticipation of a report keeps you following the trend. It’s also an excellent method of playing the increasing implied volatility going into earnings.

The Rise in Implied Volatility

What is that? Implied volatility is an essential component in options pricing. A rise in IV causes the option price to go higher, even if the stock trades flat. In the best-case scenario, the underlying stock’s price goes higher, and the implied volatility goes higher as well, leading an options trader to make money by purchasing long options before an earnings report.

The critical portion of this strategy is exiting before the earnings report, though, as the implied volatility gets crushed upon the event (and sometimes, the stock price along with it!).

Timing the Rise in Implied Volatility

Of course, this also depends on your entry and exit. I generally look for stocks that performed well post-earnings the previous quarter because this helps to add to the hype before earnings.

Remember, the entire idea with this strategy is that investors and traders are excited about the company, so they get involved before an earnings report. This does not work on stocks that nobody is interested in!

The spaces in the market where this works change over time, but generally, it’s high beta tech. That can include mega-cap tech stocks, semiconductor companies, cloud computing giants, cyber security, and more. This depends on the quarter you’re in, and it also depends on overall market conditions.

For example, I was not looking for a run into earnings throughout the bear market! I was looking for earnings destruction. This is when stocks roll over before earnings as traders and investors strive to lower their risk.

Shopify – Pre-Earnings Trend

Check out this screenshot of Shopify down below:

On the screenshot above, you can see how Shopify gapped up post-earnings in Q1. After this gap, the stock came back down to the mean. While it was volatile, it still continued along with an upward trend, before pulling back just before the report. Throughout this time, you can see how the Earnings Volatility continued increasing on a steady trajectory. Now, of course, looking back at this chart, it would depend on your entry and exit if you tried to trade this move going higher into earnings. But, the general idea is here.

Upcoming Run into Earnings Opportunity

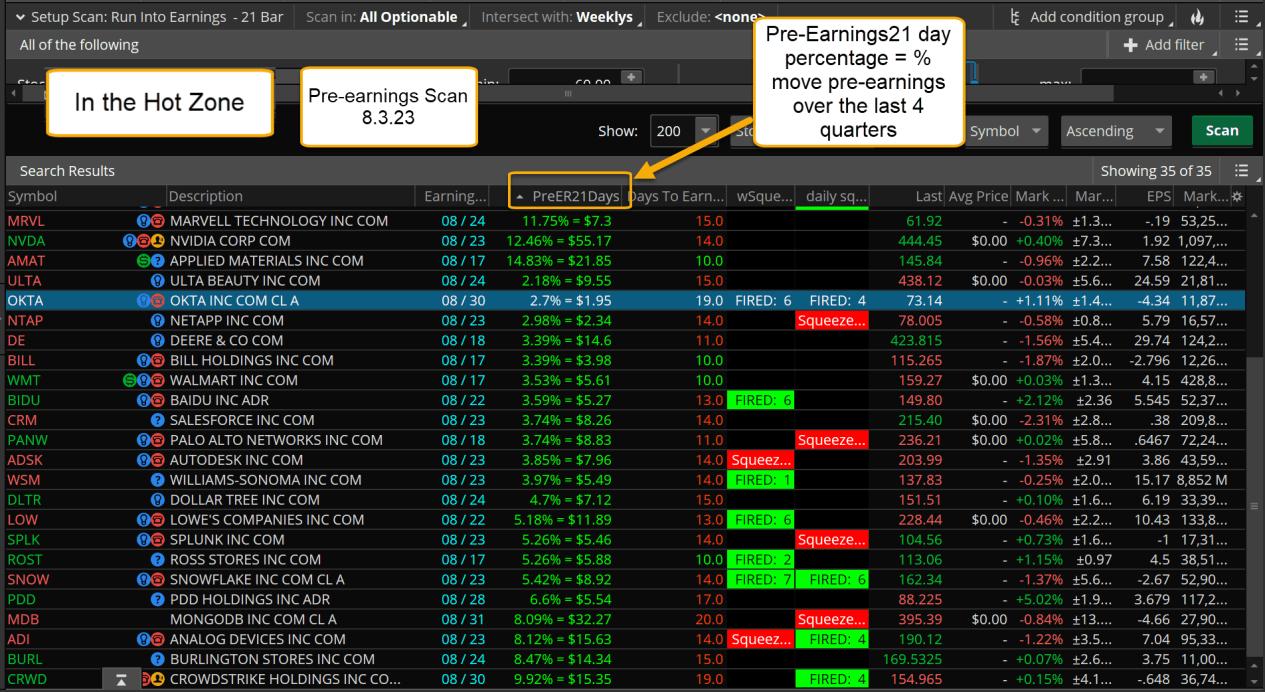

This setup had to be adjusted for the market conditions throughout the bear market. But what is great about current market conditions is that this setup is back in action. How can you tell? I use my Earnings Hot Zone tool that crunches the numbers and a few custom studies on my watchlist and scans. And these stats tell me that over the last four quarters, many tickers still have a high probability shot of making a run into earnings. These stats are based on the 21-bar time frame pre-earnings. I look for tickers entering or in the Hot Zone (the 21-bar time frame pre-earnings) and crunch the numbers to see if any tickers demonstrate regular moves pre-earnings.

Check out the results of my scan below:

Looking at the fourth column in my custom scan, you can see that most companies upcoming have a positive average during this pre-earnings time frame. Some more than others!

Specifically, Marvell (MRVL), Nvidia (NVDA), Applied Materials (AMAT), MongoDB (MDB), Analog Devices (ADI), Crowdstrike (CRWD), and Burlington Stores (BURL) are the largest statistical movers.

These are the stocks I will eye for entries for pre-earnings runs.

“What about the others,” You ask. Indeed, they can provide opportunities, but you must be more precise about your entry and exit. If a stock only moves 3-5%, you need an entry with an edge and a precise exit. Capturing a move of 8-15% doesn’t require as much finesse.

Taking an Entry

Finding an entry with an edge is the most important in this setup. Simply buying the stock 21 bars before earnings isn’t the answer. This is because the Hot Zone is just that – it’s a zone. Looking for a pullback around this time, combining it with another setup such as a squeeze or a Fibonacci cluster, is going to improve your chances. This also means taking profits after the stock moves. I generally do not hold the stock right up to the report because especially lately, the stock will sell off in the few days before the report as people take profits and/or take off risk.

Want to learn more about the Earnings Hot Zone? Click on this link for more information!